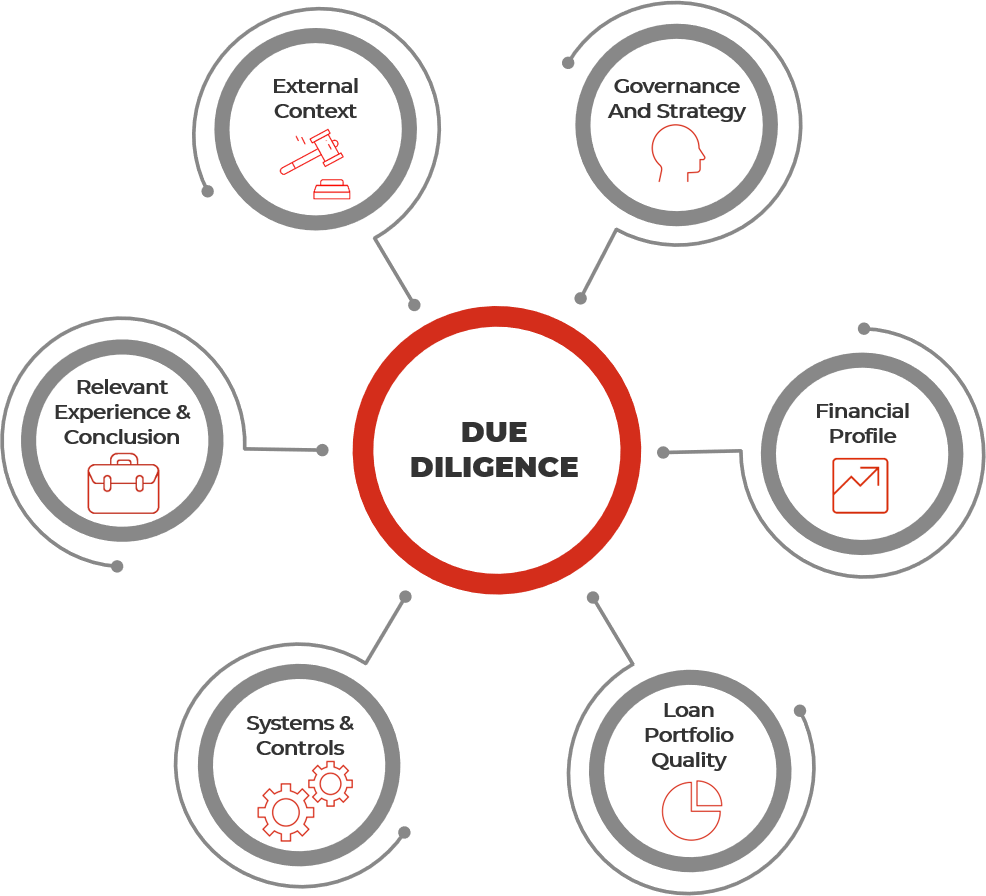

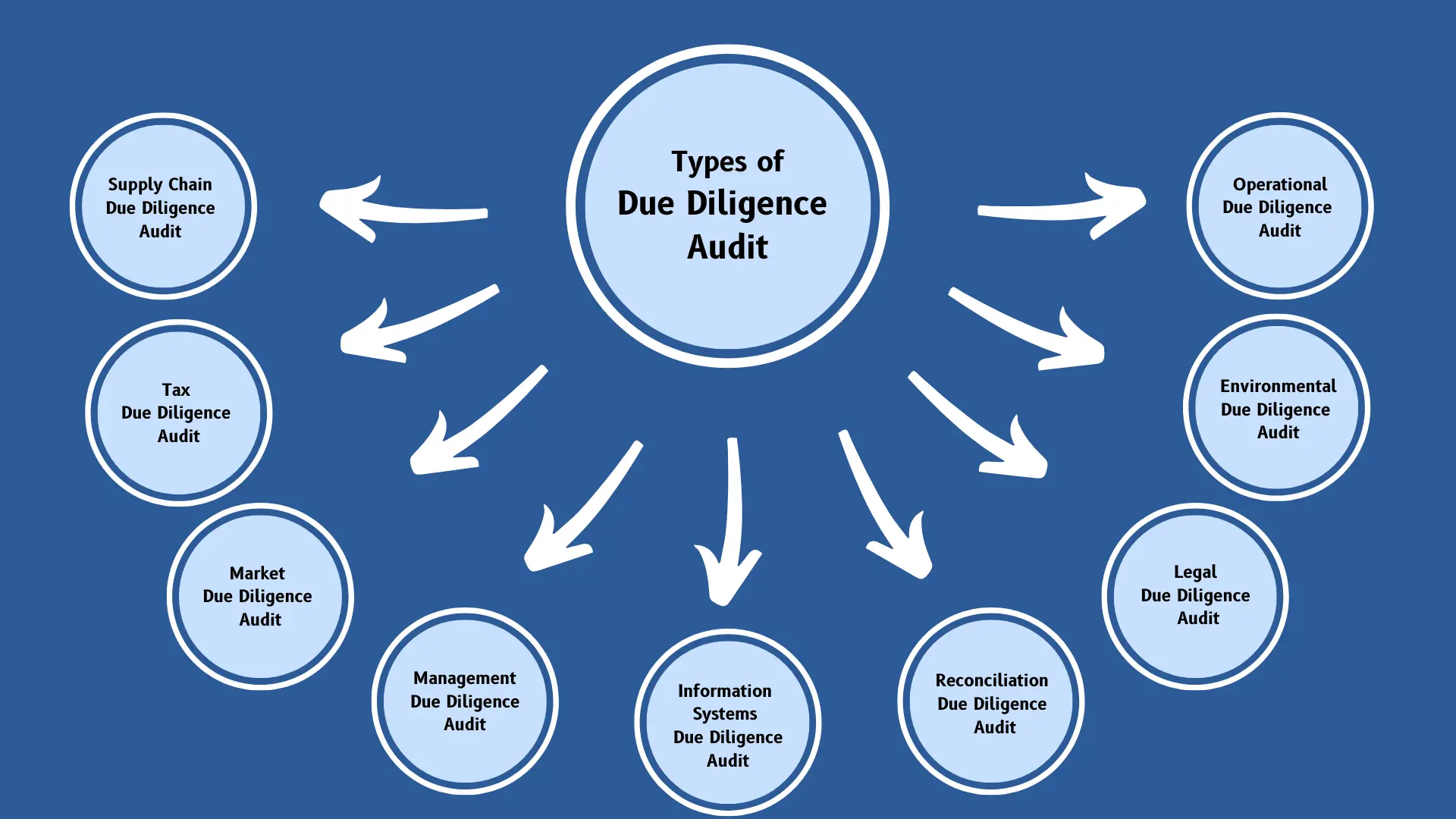

In the unique landscape of business, where organizations and speculations are ordinary, the importance of directing careful due diligence couldn’t possibly be more significant. Among the different types of due diligence, corporate due diligence checks stand out as a basic move toward protecting financial matters and mitigating risks.

Understanding Corporate Due Diligence:

Corporate diligence includes the extensive evaluation of an organization’s monetary, legal, functional, and administrative perspectives prior to entering into any business understanding or exchange. These checks give important bits of knowledge into the objective organization’s monetary wellbeing, market position, administrative consistency, and likely risks. While due diligence can include different regions, keeping up with confidentiality during the interaction is central to safeguarding the respectability of the examination and delicate data.

Preserving Confidentiality:

Confidentiality is the foundation of compelling due diligence checks. It guarantees that the data gathered during the examination stays shielded from unapproved revelation, defending the interests of all gatherings included. By keeping up with confidentiality, organizations can conduct exhaustive appraisals without endangering their standing or the honesty of the cycle.

Identifying Risks and Opportunities:

One of the essential goals of corporate diligence checks is to recognize possible risks and opportunities related to an undertaking. Whether it’s a consolidation, obtaining, association, or venture, understanding the risks implied is vital for making informed decisions. Confidential due diligence empowers partners to uncover any warnings or secret liabilities that could influence the achievement or reasonability of the exchange.

Enhancing Decision-Making:

In the present high-speed business climate, decisions should be made quickly and with certainty. By leading careful due diligence checks, organizations arm themselves with the data expected to use wise judgment. Whether it’s chasing after a worthwhile open door or leaving an unsafe endeavor, the bits of knowledge acquired from confidential due diligence engage partners to settle on informed decisions aligned with their essential goals.

Mitigating Legal and Reputational Risks:

Inability to lead legitimate due diligence can expose organizations to a bunch of legal and reputational risks. From undisclosed liabilities to administrative rebelliousness, neglecting basic data can have extensive results. Confidential corporate due diligence checks act as a defensive measure, assisting organizations with identifying possible legal traps and reputational risks before they grow into exorbitant questions or harm the organization’s brand.

Building Trust and Credibility:

In the present interconnected business-biological system, trust and credibility are important resources. By exhibiting a guarantee to straightforwardness and honesty through confidential due diligence checks, organizations cultivate trust with partners, including financial backers, accomplices, and clients. Trust is the groundwork of effective business connections, and directing exhaustive due diligence supports an organization’s standing as a solid and trustworthy accomplice.

Confidential due diligence checks assume a critical role in mitigating risks, enhancing decision-making, and shielding the interests of organizations in the present serious landscape. Whether it’s assessing expected acquisitions, shaping key associations, or entering new business sectors, confidential due diligence checks provide the bits of knowledge expected to explore complex deals with certainty and lucidity. In a time characterized by vulnerability and unpredictability, putting resources into extensive due diligence isn’t simply a judicious decision; it’s a fundamental stage towards guaranteeing long-term achievement and manageability.